In the November 2010 edition of Post Magazine, Director Stephen Frears says about Music Composer Alexandre Desplat, "He gives me what I don’t know that I want, because I haven’t a clue (laughs)." So many creative works from teams, whether it be movies or video games or what have you, would be better off if the principals had that attitude.

Friday, November 12, 2010

Wednesday, October 27, 2010

"Fair Value" Income Portfolio

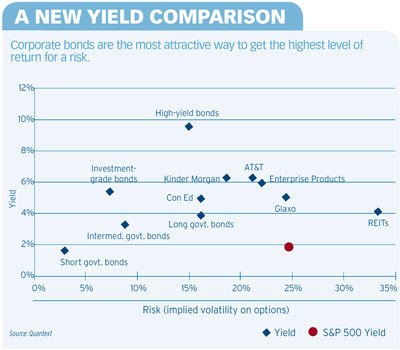

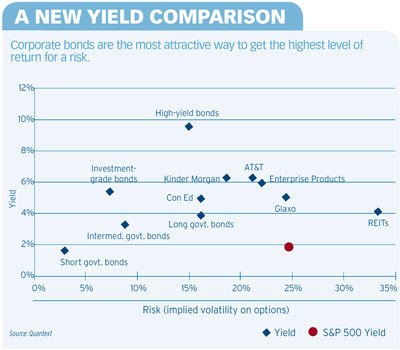

Geoff Considine, another one of my favorite investment authors, wrote an article called Yield vs. Risk in the October 2010 article of Financial Planning. In it he provides a chart of the yield of various income vehicles as a function of risk:

Based on this chart, he later constructs a portfolio that he calculates will return 6.8% annually with volatility of 11.4%, less than half of that of the S&P 500:

He calls this the "fair value" income portfolio where its expected total return is what it's current yielding.

Note that Kinder Morgan and Enterprise Products are MLPs, and you can probably substitute any of the MLP ETNs or one ETF for it (although there has been some controversy over their effectiveness as investment products). You can probably also use utility and/or telecomm funds for Con Ed and AT&T.

This is probably a good starting point for a domestic income portfolio. I think to round things out, you've got to go international. Add in REITs, TIPs, and peer-to-peer as well.

Based on this chart, he later constructs a portfolio that he calculates will return 6.8% annually with volatility of 11.4%, less than half of that of the S&P 500:

He calls this the "fair value" income portfolio where its expected total return is what it's current yielding.

Note that Kinder Morgan and Enterprise Products are MLPs, and you can probably substitute any of the MLP ETNs or one ETF for it (although there has been some controversy over their effectiveness as investment products). You can probably also use utility and/or telecomm funds for Con Ed and AT&T.

This is probably a good starting point for a domestic income portfolio. I think to round things out, you've got to go international. Add in REITs, TIPs, and peer-to-peer as well.

Sunday, October 24, 2010

The Mythical X-Curve

I remember reading this when I first stumbled across it maybe a decade ago. It's just as interesting and applicable now as it was then.

The Mythical X-Curve

This one speaks for itself. I'd love to actually experience a movie in one of John F. Allen's theaters. Too bad there aren't any in California.

The Mythical X-Curve

This one speaks for itself. I'd love to actually experience a movie in one of John F. Allen's theaters. Too bad there aren't any in California.

Setting The Subwoofer Level

The best succinct article I've read about properly calibrating a sub is by Tom Holman in the September 2001 issue of Digital TV magazine (which I've not been able to find online), so I'm paraphrasing it here. Because of the initial works of Fletcher and Munson in the 1930's (nowadays we use the updated ISO standard), we know that our perception of loudness is not very flat, and it takes more bass energy to sound equally as loud as the midrange. To get that extra headroom to achieve "equal" loudness, the LFE channel is "turned down" by 10dB in the medium and "turned back up" by the end user's equipment. Work by Eric Benjamin of Dolby Labs confirms that this 10dB amount is a good choice. However, since the bandwidth of the LFE channel is less, it should NOT measure 10dB greater using noise. The best way to set the level is to observe 10dB in-band gain above that of one of the main channels in its operating frequency. In other words, with a 1/3-octave RTSA, if the center channel measures 70dB SPL, then the LFE should read 80dB SPL in its active bands. In a pinch, with your typical Radio Shack analog SPL meter on the C-weighted curve (which rolls off the bass), the LFE with band-limited pink noise should measure approximately 4dB greater than one wideband channel playing pink. The best way is still to use an RTSA though. Holman also mentions this in his book Surorund Sound: Up And Running on page 60. You can read it for yourself on Google Books.

Wednesday, October 13, 2010

A Multi-Asset Portfolio Is Best For Withdrawels In Retirement

You don't want to run out of money in retirement, so your investment portfolio should be constructed in a way to last your golden years. One of my favorite financial planning authors Dr. Craig L. Israelsen provides evidence that a multi-asset portfolio equally-weighted in large U.S. stock (S&P500), small U.S. stock (Russell2000), foreign stock (EAFE), real estate (NAREIT), commodities (GSCI), U.S. bonds (Barclays Aggregate), and cash (3-month T-bills) outlasts standard portfolios of 60/40 stocks/bonds, 40/60 stocks/bonds, and 100% bonds in a May 2010 article at Financial Planning entitled "Built To Last."

The rule of thumb for retirement nest egg withdrawels is typically 4% annually with an inflation increase per year of about 3% of the withdrawel amount (a COLA). For example, with a $1,000,000 nest egg, the first year amount would be $40k, the second year would be $41.2k, etc... Dr. Israelsen back-tested several 25-year rolling retirement periods using the above portfolios, and although all portfolios survived all periods using a 5% withdrawel rate, only one survived all periods using an 8% withdrawel rate: the robust multi-asset portfolio. Notably the most brutal 25-year periods all started in the early 1970's.

I'd be really interested in knowing how well things would've have fared earlier, since one can argue that historically we've seen the most rapid growth in assets in the last 30 years or so. 30-year rolling retirement periods might be a more accurate norm for retirement now, now that we're all living longer, in which case the 4% annual withdrawel rate is safer for not running out of money.

The rule of thumb for retirement nest egg withdrawels is typically 4% annually with an inflation increase per year of about 3% of the withdrawel amount (a COLA). For example, with a $1,000,000 nest egg, the first year amount would be $40k, the second year would be $41.2k, etc... Dr. Israelsen back-tested several 25-year rolling retirement periods using the above portfolios, and although all portfolios survived all periods using a 5% withdrawel rate, only one survived all periods using an 8% withdrawel rate: the robust multi-asset portfolio. Notably the most brutal 25-year periods all started in the early 1970's.

I'd be really interested in knowing how well things would've have fared earlier, since one can argue that historically we've seen the most rapid growth in assets in the last 30 years or so. 30-year rolling retirement periods might be a more accurate norm for retirement now, now that we're all living longer, in which case the 4% annual withdrawel rate is safer for not running out of money.

Passive Mutual Funds Beat Active

There's an interesting paper on why indexes are a better investment than mutual funds. It's called "The Difficulty of Selecting Superior Mutual Fund Performance" and was in the 2006 February issue of the Journal of Financial Planning. The bullet points:

- Few active mutual funds can consistently beat their respective indexes, but there are some that do.

- Predicting which active mutual funds will outperform, however, is difficult, if not impossible.

- The cost of selecting the wrong manager was high, and probably not worth the risk.

- Active mutual funds provide significantly lower after-tax returns.

Thursday, September 9, 2010

Emerging Markets now available to 529 plans

It's been impossible to customize the allocation of Emerging Markets in a 529 college savings plan portfolio... until now. You can now invest in the iShares MSCI Emerging Markets Portfolio (EEM) via the Arkansas/iShares 529 Plan. Downside? A 1.10% annual fee, ouch! Compare that to Vanguard's Emerging Markets Stock ETF (VWO) at 0.27% which also has better tracking. Granted, there would be a markup for 529 administration and the sponsoring state, but it would still be about half of what the iShares version costs. Well at least we have the option now...

Sound Speak - Phillip Noyce on the Audio of Salt

Excertps from Phillip Noyce as he talks about the sound of his movie "Salt" from the August 2010 Mix Magazine article.

“In this particular film, music drives the soundtrack, and that’s quite unusual for an action film, where usually it’s the effects that drive the sound. The reason music drives the film is because I’ve used James Newton Howard’s score as the unifying factor to combine what is on the one hand fantastical, escapist popcorn entertainment, and on the other hand, a fact-based thriller—two seemingly irreconcilable genres that are pulled together and held tight by James’ score. Everything, in a sense, was subordinated to the music.”

“I’ve always believed in using sound as an ‘emotionator,’ if I can make up a word,” Noyce laughs. “No sound is innocuous, no musical note is innocuous. They simply exist. Whether it’s the rustle of the wind, the sound of birds, the footsteps or the strings, they all have a dramatic and an emotional purpose within the soundtrack.

“We set out at the beginning of the sound work with a number of objectives,” he continues. “One was to ensure that as a ride, Salt is relentless. Once the audience gets on, we want the roller coaster to never stop. The audience has nowhere to hide, you just hold on and hope you get to the end with your brain intact. That means you are trying to create incessant rhythms of sound. There can be no pause. You’re trying to hit them and hit them and hit them as if you have them against a wall, punching them. But you want them to feel as if you’re just stroking them, because you want them on the edge of their seats wanting more. Every time they might want to feel like a pause, there’s another sound ricocheting into the next sound, that’s bouncing forward into the next one. And they keep going within a rhythm that’s relentless. The trick is to find the right level, and I don’t mean volume. I mean the right level of complexity without ever being bombastic.”

“In this particular film, music drives the soundtrack, and that’s quite unusual for an action film, where usually it’s the effects that drive the sound. The reason music drives the film is because I’ve used James Newton Howard’s score as the unifying factor to combine what is on the one hand fantastical, escapist popcorn entertainment, and on the other hand, a fact-based thriller—two seemingly irreconcilable genres that are pulled together and held tight by James’ score. Everything, in a sense, was subordinated to the music.”

“I’ve always believed in using sound as an ‘emotionator,’ if I can make up a word,” Noyce laughs. “No sound is innocuous, no musical note is innocuous. They simply exist. Whether it’s the rustle of the wind, the sound of birds, the footsteps or the strings, they all have a dramatic and an emotional purpose within the soundtrack.

“We set out at the beginning of the sound work with a number of objectives,” he continues. “One was to ensure that as a ride, Salt is relentless. Once the audience gets on, we want the roller coaster to never stop. The audience has nowhere to hide, you just hold on and hope you get to the end with your brain intact. That means you are trying to create incessant rhythms of sound. There can be no pause. You’re trying to hit them and hit them and hit them as if you have them against a wall, punching them. But you want them to feel as if you’re just stroking them, because you want them on the edge of their seats wanting more. Every time they might want to feel like a pause, there’s another sound ricocheting into the next sound, that’s bouncing forward into the next one. And they keep going within a rhythm that’s relentless. The trick is to find the right level, and I don’t mean volume. I mean the right level of complexity without ever being bombastic.”

Sunday, April 4, 2010

Use Dialog to Calibrate Loudness

In the 115th AES Convention paper "Intelligent Program Loudness Measurement and Control: What Satisfies Listeners?" 19 of 21 listeners agreed with each other to within 1dB when evaluating the subjective loudness of speech. However, they disagreed when asked what constitutes "appropriate" loudness for footsteps. Also in the paper, TV listeners preferred dialog at 60.5 dB SPL versus 69 dB in home theaters. Normal conversational speech fall in the range of 55 to 66 dB SPL. All SPL is measured at A-weighted, slow.

Wednesday, March 24, 2010

Stock Market Capitalization Performance On Key Dates Since October 2007

Austria and Kuwait have both done horribly -- value! Colombia and Qatar - resiliency! Indonesia and India on a tear -- momentum!

https://spreadsheets.google.com/ccc?key=0AjFjvvkp-He7dGpSQ29yMU5RcjZ1ZE1GZXVNNVJlTUE&hl=en

https://spreadsheets.google.com/ccc?key=0AjFjvvkp-He7dGpSQ29yMU5RcjZ1ZE1GZXVNNVJlTUE&hl=en

Tuesday, March 9, 2010

No Market Timing Newsletters Called The Tops Or Bottoms Of The Last Decade

A recent article mentions that of the hundreds of market timing newsletters that the Hulbert Financial Digest tracks, none were able to call the market top or bottom of the last year, or for that matter the major tops/bottoms of the last decade. This is even amidst loose definitions of what "calling" means. It just goes to show that timing the market is EXTREMELY difficult to do, even by those that make a living off of it.

Friday, January 29, 2010

Annual Returns By Asset Class 1999 to 2009

A great chart from Research Affiliates in this article "Was It Really A Lost Decade?" "EW Asset Classes" stands for equally weighting the asset classes in a portfolio. Perhaps a good starting point to decide on your own asset allocation?

Wednesday, January 6, 2010

Performance of an Equally-Weighted Portfolio Annually Rebalanced from 1970-2008

Dr. Craig Israelsen is out with another well-documented article "Actively Passive" in the first 2010 issue of the Journal of Indexes. In it, he notes that an equally-weighted portfolio of 7 assets rebalanced annualy had a 39-year annualized return of 10.21% from 1970-2008, outperforming various other investigated "actively passive" strategies except for one: selecting the best-performing index from the prior year (a kind of momentum investing) which returned 13.92% annually, but with nearly 2.5x more volatility. I'm thinking the best bang-for-your-buck strategy for an individual investor is to half utilize a similarly weighted portfolio that's tweaked a bit more towards international and emerging markets, half utilize a momentum strategy (if one can stomach that roller coaster ride), rebalance when things get too far awry (but not too frequently), utilize a moving-average crossover system for risk management (or temporal diversification) similar to those discussed by Mebane T. Faber and Theodore Wong, and all the while keeping a close eye on costs (transaction fees and taxes). That'll do pig, that'll do.

Labels:

actively passive,

asset allocation,

portfolio,

rebalancing

Subscribe to:

Comments (Atom)