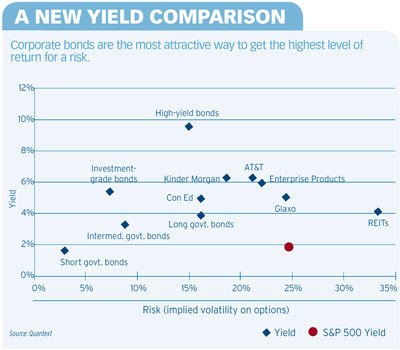

Based on this chart, he later constructs a portfolio that he calculates will return 6.8% annually with volatility of 11.4%, less than half of that of the S&P 500:

He calls this the "fair value" income portfolio where its expected total return is what it's current yielding.

Note that Kinder Morgan and Enterprise Products are MLPs, and you can probably substitute any of the MLP ETNs or one ETF for it (although there has been some controversy over their effectiveness as investment products). You can probably also use utility and/or telecomm funds for Con Ed and AT&T.

This is probably a good starting point for a domestic income portfolio. I think to round things out, you've got to go international. Add in REITs, TIPs, and peer-to-peer as well.

No comments:

Post a Comment