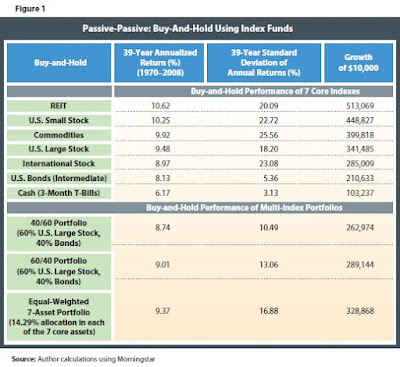

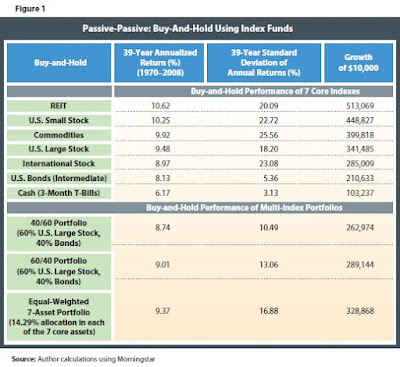

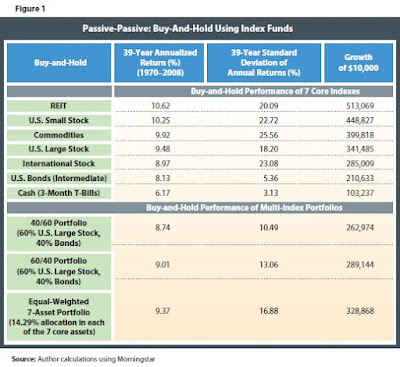

Dr. Craig Israelsen is out with another well-documented article

"Actively Passive" in the first 2010 issue of the Journal of Indexes. In it, he notes that an equally-weighted portfolio of 7 assets rebalanced annualy had a 39-year annualized return of 10.21% from 1970-2008, outperforming various other investigated "actively passive" strategies except for one: selecting the best-performing index from the prior year (a kind of momentum investing) which returned 13.92% annually, but with nearly 2.5x more volatility. I'm thinking the best bang-for-your-buck strategy for an individual investor is to half utilize a similarly weighted portfolio that's tweaked a bit more towards international and emerging markets, half utilize a momentum strategy (if one can stomach that roller coaster ride), rebalance when things get too far awry (but not too frequently), utilize a moving-average crossover system for risk management (or temporal diversification) similar to those discussed by

Mebane T. Faber and

Theodore Wong, and all the while keeping a close eye on costs (transaction fees and taxes). That'll do pig, that'll do.

No comments:

Post a Comment